Welcome to Purple Pawn, covering games played around the world by billions of people every day.

Two years ago, we delivered a fairly in-depth review of the state of Games Workshop as a publicly traded company. Given everything that’s happened to Games Workshop in the interim, it seemed appropriate to revisit that assessment.

Two years ago, we delivered a fairly in-depth review of the state of Games Workshop as a publicly traded company. Given everything that’s happened to Games Workshop in the interim, it seemed appropriate to revisit that assessment.

But first, a bit of record keeping – in that article, we made a few predictions on what was coming next from GW:

- Slowdown in Regular Releases: We get a partial hit on this one. While the 40K and Fantasy lines continue to chug out at the normal pace, the marked drop in Lord of the Rings and Specialist Games products definitely constitutes a slowdown overall.

- More Bundle Deals: GW has really been pushing the bundle model with dedicated box sets and online deals designed to get more product into player’s hands (including the premium bundles for new rulebooks!).

- More Player-Initiated Events: We definitely nailed this one – Planetside, Planetary Empires, Spearhead – GW thinks they’ve struck gold with this model and they don’t show any sign of slowing down.

Not bad overall. Before we take a look in our crystal ball for the next two years, let’s take a look at where GW stands today.

Financials

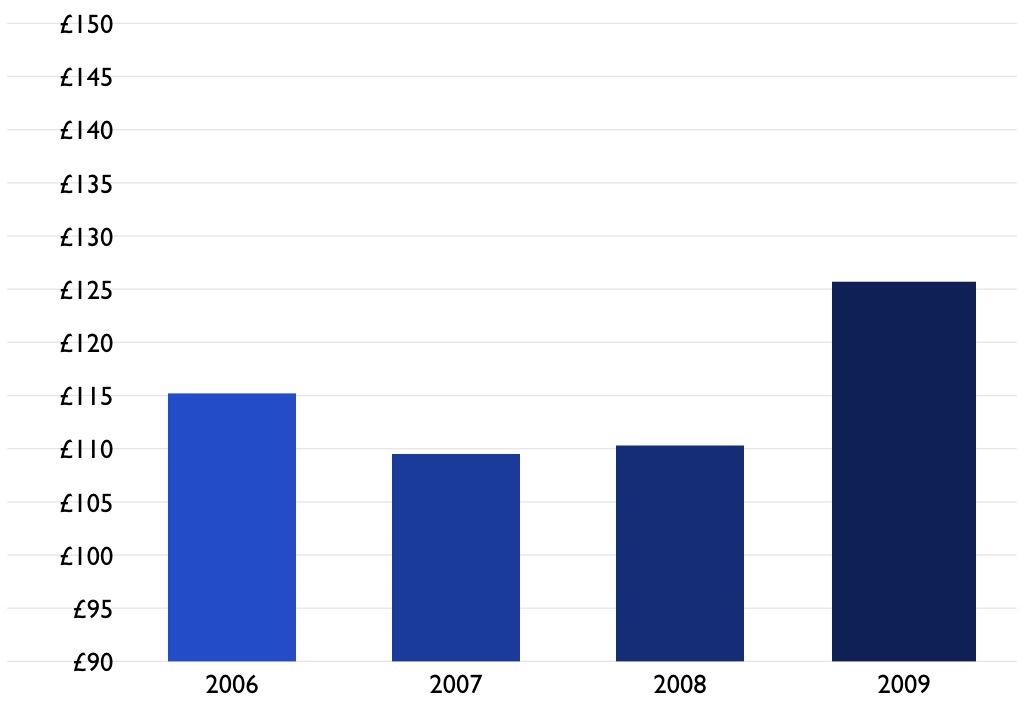

Financially, GW seems to have turned a real corner. In terms of raw revenue, we see that 2007 and 2008 were both down years, but 2009 was fairly strong. General industry wisdom is that macro-economic events (like worldwide recessions) don’t generally impact niche/hobby industries. This tends to be a fairly pollyanish view of the world to be honest and GW’s revenue reflects the broader commercial sector fairly accurately, showing a recovery that started last year into this year. What this does tell us is that GW is about as stable as they’ve been for the past decade – reliable, but not necessarily the company you want to bet your retirement on. That said, GW’s revenue is not all that interesting from a gamer’s perspective – for those nuggets, we need to dig a bit deeper.

Financially, GW seems to have turned a real corner. In terms of raw revenue, we see that 2007 and 2008 were both down years, but 2009 was fairly strong. General industry wisdom is that macro-economic events (like worldwide recessions) don’t generally impact niche/hobby industries. This tends to be a fairly pollyanish view of the world to be honest and GW’s revenue reflects the broader commercial sector fairly accurately, showing a recovery that started last year into this year. What this does tell us is that GW is about as stable as they’ve been for the past decade – reliable, but not necessarily the company you want to bet your retirement on. That said, GW’s revenue is not all that interesting from a gamer’s perspective – for those nuggets, we need to dig a bit deeper.

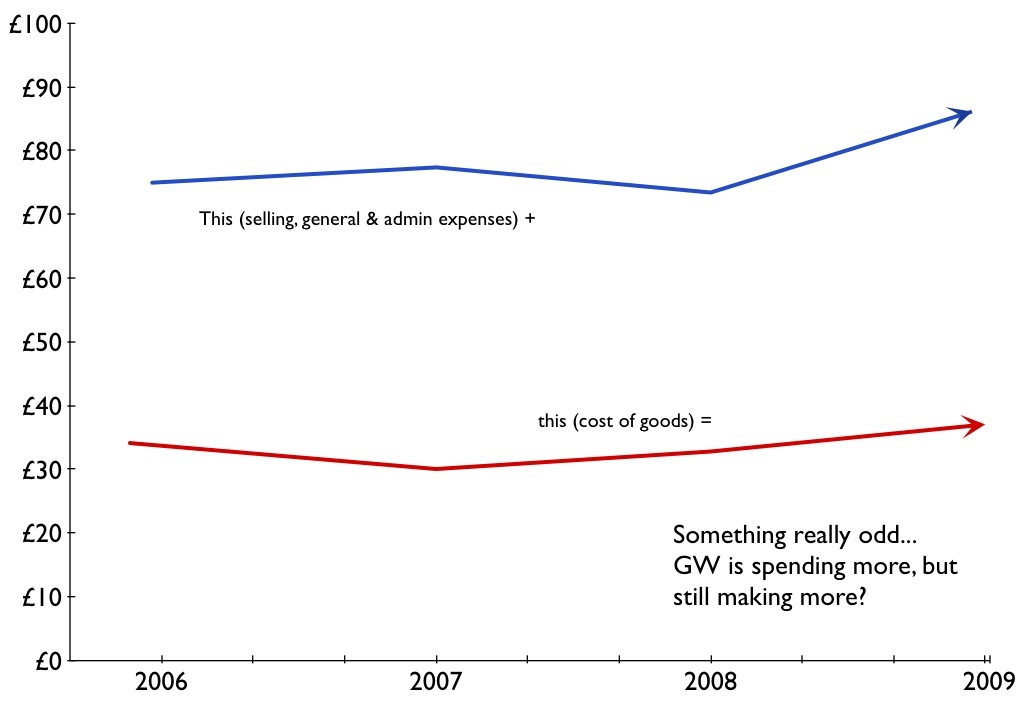

Digging deeper into the 2009 report, we find that GW’s sales have increased – this is great! Until you realize they’re talking about sales in terms of value, not in terms of volume. Big difference. GW states that sales are actually somewhat disappointing and were actually down during the critical final quarters (akin to the US holiday shopping season). Which brings us to our handy little graph to the side – the amount of money GW needs to deliver products to us, the consumers, has been steadily increasing, with some notable jumps in 2009 in terms of raw costs and admin/expense costs – yet, their gross and net profit both increased significantly. Is this the result of gouging or are sales steadily increasing overall (in spite of the holiday dip)?

Digging deeper into the 2009 report, we find that GW’s sales have increased – this is great! Until you realize they’re talking about sales in terms of value, not in terms of volume. Big difference. GW states that sales are actually somewhat disappointing and were actually down during the critical final quarters (akin to the US holiday shopping season). Which brings us to our handy little graph to the side – the amount of money GW needs to deliver products to us, the consumers, has been steadily increasing, with some notable jumps in 2009 in terms of raw costs and admin/expense costs – yet, their gross and net profit both increased significantly. Is this the result of gouging or are sales steadily increasing overall (in spite of the holiday dip)?

And that brings us to everyone’s favorite topic, price increases. We always talk about how it seems like prices go up two or three times a year, but have you ever looked back over the history of these things and figured out how often they actually occur? I did. It’s not actually as frequent as you might think – it’s about one a year. That said, they’re averaging somewhere between 4%-15% depending on the specific product you look at. It’s impossible to tell how much these prices increases are truly contributing to GW’s increased bottom line without actual volume data, but a bit of basic math does provide a few clues.

GW claims that in 2009, they were able reduce the percentage of sales cost due to goods “from 29.81% to 28.57%” or about a 1.24% drop. This is handy, because it allows us to do adjust these costs from 2009 to ignore this benefit and get a better idea of how much product was actually created (i.e.: volume – this isn’t perfect, but it’s as good as we’re likely to get). When we do this, we see that GW probably produced more product in 2009 – about a 9.5% increase. Not bad at all. So we should see a similar increase in revenue (since we’ve factored out the benefits of their increased efficiency in the raw goods department – again, this isn’t perfect, but it should be in the neighborhood). And here’s where your average gamer gets a bit annoyed: a 12.25% increase in revenue. Roughly 3% over what we would have expected from pure volume. To be clear, what we’ve done here isn’t exact – variables like fluctuations in sales on premium products vs. evergreen products (which are typically priced as loss-leaders) can throw an analysis like this right out the window.

So is GW an evil, money-grubbing corporation? Not really. That 3% increase we talked about? When you go through everything, that increase is nearly solely responsible for GW being in the black in 2009, with a net income of £5.6MM (it seems like a lot, but that’s not really all that great for a company the size of GW) as opposed to the outright loss they took in 2008 & 2007. When you factor in the 2.4% rate of inflation/year in the UK, there’s a strong chance that GW’s management might actually know what they’re doing. Much as I want to rake them over the coals, GW has done what they needed to in order to survive – and if I enjoy their products, that’s just going to have to be something that I accept.

Predictions

Now that we’ve got that out of the way, what’s next for GW? My suspicion is they’re going to play it safe. They’ve found a plan that allows them to keep costs down and keeps product moving – I don’t see any radical reinventions in their future. Instead, I think you’ll see GW focus on three key things:

- Merchandising/Licensing – Let’s face it, Black Library does some darned fine work. Great writers telling genuinely interesting stories about some truly epic characters – what’s not to love? We’ve had a few hits and misses with regards to video games, but nothing that’s really taken a life of it’s own until Dawn of War (and the inevitable sequel). Even better, GW is being very public about their upcoming Ultramarines movie (which is looking spectacular to be honest). Heck, they’ve even figured out how to return to their glory days with regards to board games (admittedly by using Fantasy Flight Games as a proxy). It’s official – GW has figured out that they’ve got a ton of value locked up and they’re not making the best use of it. Expect more movies, more books, more comic books and at least a few more attempts at a blockbuster video game.

- More, but Smaller Events – We’ve already seen the first moves towards running more events that aren’t quite as epic as the Games Day events. Games Workshop has even been partnering with smaller events, providing direct support to these events. Expect this to continue with GW pushing more events as part of their program to keep new players engaged.

- Focus on Hobby Support – Think Spearhead and all of these other mini-supplements are about getting you to buy more models? OK…they are, but that’s not all they’re about. They’re also about making sure you’re staying engaged in the hobby – in other words, getting you to build on what you’ve got without making you choose between starting a new army and ignoring the newest hotness.

Wrap-Up

So all in all, where is Games Workshop today? I think they’re looking pretty solid. They’ve finally got their financial house in order, gamers are buying more product than ever and they’ve figured out how to leverage their huge base of intellectual property to generate new fans and excite old ones. In a lot of ways, this is a return to GW’s glory days of the 90’s – a juggernaut in the hobby gaming industry who’s intellectual property permeates every aspect of gamer culture. And I for one, couldn’t be more excited.

18 Comments

Sorry, the comment form is closed at this time.

Trending

- Massdrop.com

- Oh the Irony—Illuminati Card Game Continues to Inspire Conspiracy Theorists

- Footprints, an Educational Ecology Game

- Home

- USPS Adds Board Game Flat Rate Box

- Baila, the Estonian Drinking Card Game

- Crystal Caste Wins Dice Patent Suit Against Hasbro

- Mirror Game, Red and Blue

- Are Board Games Dangerous?

- Board Games Based on Hindu Mythology

Archives

Most Popular Articles

- Oh the Irony—Illuminati Card Game Continues to Inspire Conspiracy Theorists

- The 20 Most Valuable Vintage Board Games

- The Truth About Dominoes On Sunday in Alabama

- Sequence Game, and Variants

- USPS Adds Board Game Flat Rate Box

- Baila, the Estonian Drinking Card Game

- The 13 Most Popular Dice Games

- Are Board Games Dangerous?

- Guess Who? The Naked Version

- What Happened to the Jewel Royale Chess Set?

Recent Posts

- Toy Fair 2019—Breaking Games

- Talisman Kingdom Hearts Edition

- Toy Fair 2019—Winning Moves

- Toy Fair 2019—Games Workshop

- Toy Fair 2019—Star Wars Lightsaber Academy

- Toy Fair 2019—Stranger Things Games

- Toy Fair 2019—HABA

- Licensing Roundup

- Game Bandit

- 2018 A Difficult Year For Hasbro But Not For D&D Or MtG

Recent Comments

- on Toy Fair 2019—Winning Moves

- on Game Bandit

- on Second Look—Dungeons & Dragons Waterdeep Dragon Heist

- on Crowdfunding Highlights

- on Beyblade SlingShock

- on Game Bandit

- on Game Bandit

- on Watch This Game!, the Board Game Review Board Game

- on Second Look—Vampire: The Masquerade 5th Edition

- on Palladium Books Loses Robotech IP License, Cancels Five-Year-Overdue Robotech RPG Tactics Kickstarter

Wow. Excellent work! Now, if we can just get them to re-issue Blood Bowl…

I wonder what FFG would do with it!?

” the marked drop in Lord of the Rings and Specialist Games products definitely constitutes a slowdown overall.”

Specialist Games was shut down years ago. Its not a slowdown. They don’t release anything for any of the Specialist Games range with the exception of the odd Blood Bowl mini.

I wouldn’t call it shutdown – GW still spends some time with the intellectual property in SG and (as you point out) occasionally throws us a bone in the way of a Blood Bowl resculpt. That said, two years ago, GW was at least pretending like they might produce more SG miniatures ;) (am I the only one who still desperately yearns for a rework of Necromunda’s minis…).

You might be the only one yearning for Necromunda. Replace Necromunda with Mordheim, however, and I’m right there with ya’.

One thing you don’t mention is the impact of the fall in the value of the £ vs the US$. This has had a massive impact on their 2009 numbers (which are of course denominated in £) to the tune of a few £million, as US$ sales are worth around 20% more in £ than they were a couple of years ago (the £ fell from $2=£1 to c.$1.5=£1 during that time).

If you strip of this (hopefully!!!) one-off devaluation of Sterling, then GW’s US sales volume is not looking so healthy.

Or at least that’s my reading of their accounts.

Usually, you’d be right about currency conversion. However, in 2009 the Sterling actually improved against the US Dollar (on average – the Sterling took a pounding in the last half, but still ended significantly better than it started in 2008), meaning the conversion actually helped this time (they factor this out in the earnings reports – it’s not huge [.5mm]), but it’s a definite reversal from 2007 & 2008 where they lost on conversion. They call this out in the 2009 earnings report, but don’t spend a lot of time on the topic.

[…] This post was mentioned on Twitter by Coach, Purple Pawn. Purple Pawn said: Games Workshop in Review: Two Years Later: Two years ago, we delivered a fairly in-depth review of the state of Ga… http://bit.ly/9cxKn3 […]

But that’s the point: they gained £500k from “currency movements” and not from the sale of minis. They saw 3% growth in the US on a “constant currency” basis (per note at top of page 9 of the 2009 accounts) which is hardly even inflationary – so pretty much must mean a volume decrease.

The only area to see above-inflationary growth was the UK (12%), and this can be explpained by online sales bleed from the US, Australia and Eurozone where prices are more expensive.

So while there (as the report acknowledges) there was very modest sales growth, its nothing to write home about, and is severely threatened by such measures as higher-than-inflation price increases and restricting the value on offer from online discounters.

GW are treading a very fine line at the moment between maximising per unit and maintaining sales volume. It really could go either way.

There’s no edit button, so I apologise for the additional post, but looking at their reported exchange rate numbers in more detail, it seems that the value of the £ vs the $ fell from 2.01 in 2008 to 1.63 in 2009 so before hedging, every dollar they earned this year was worth 19% more this year than it was last year. So I really think there is a lot more to this than the £500k reported in my post above. The headline figures in the financial headlines on page 1 of the accounts show, for instance, that under constant currency, turnover would have been reported as £113.9M rather than the actually reported £125.7M – so at constant currency, group turnover from all sources and regions only increased by £3.6M or 3.26%. Barely inflationary, as I said.

Sorry – you raise a really good point around the currency fluctuations and it’s impact on their sales figures. That said, if you look at the trend of their sales figures with an adjustment for currency (which they do in the annual report), the picture looks a bit healthier. Like I said, I wouldn’t invest in GW as a retirement option(not that I should be used for investment advice at all!) – they just don’t have the financials that I associate with a healthy company at that size. However, their results are positive and it looks like they’re doing what they need to do (though obviously with some pain on the consumer end). I feel it’s safe to say that they’ve turned a corner (sales are trending up, costs are being controlled better and their outstanding debt is steadily dwindling), but to your point, they could easily slide back if they choose to ignore the lessons of the last few years.

(and no need to apologize – this is really great discussion ;) )

I think we are coming at this from the same angle perhaps then. Their results last year were not disastrous, but far from brilliant from an investors POV. Turned a corner – well the downward trend has been halted. Perhaps a little too early to say trending up really I personally would think, but we are both having to make a lot of assumptions so I wouldn’t champion my assumptions over yours.

Their recent profit announcements have been interesting. (e.g. http://www.reuters.com/finance/stocks/keyDevelopments?rpc=66&symbol=GAW.L×tamp=20100505064800) as they indicate continued profit growth, which is good. How much of that is attributable to growth in global sale, and how much to more short-term items such as cost cutting and licence revenue, we will have to see when the accounts are out next month, but I am guessing a similar story to last year – i.e. barely inflationary growth.

Given Kirby’s comments every year a few years back were about GW being a company focussing on “long term growth”, this does seem a little worrying, but I am jumping the gun of course!

I must admit that as a gamer I dislike >inflationary price rises that put me off buying stuff, and I dislike anything that reduces the player base that makes it harder to get a game. As a potential investor, I have not however been put off not by these parochial issues. More seriously I am put off investing precisely because since 2001, GW seem to have been unable to deliver on their promise of long term growth. And in the absenfe of any inside information, I would proxy long term growth with a notional level of “real” turnover, discounted for inflation. If you strip out the LotR bubble level of sales, GW’s underlying “real” turnover hasn’t gone up anything to speak of since the turn of the millennium.

See the following graph: http://img28.imageshack.us/img28/3897/2009toandpat.jpg

Sure 2009 looks good for sales at last, but we can lose pretty much all of that uplift by removing that one-off currency effect, so generally sales are still bumping along at pre-LotR-bubble levels. Which given there are still *some* LotR sales in the mix, doesn’t look good for sales of 40k/WFB stuff. And if you aren’t selling more of your core products year on year, then you aren’t “growing”, and you run out of costs to cut and you’re back making a loss again.

Until GW shows it is really growing sales of its core products, I really can’t see it as being out of the woods. Everything else, while sensible and beneficial no doubt, is really just window dressing.

And how else will they grow sales other than by convincing their customers (potential and current) that they are offering good value for money? And how do they plan to do that if they continue to make such moves as increasing their plastic model prices up to the levels where other people pitch metal models, reducing shop opening hours, offering poorer trade terms, etc., etc.?

Colour me skeptical!

Nice analysis. But one point:

“And here’s where your average gamer gets a bit annoyed: a 12.25% increase in revenue. Roughly 3% over what we would have expected from pure volume.”

If that’s the case, then the average gamer should probably be taken off life support because their upper brain functions have clearly atrophied away.

They increased their prices and their revenue-per-sale increased? Wow. That’s bizarre. It’s almost as if increasing the price of something meant that you were charging more money for it.

You might be a bit uncharitable there – keep in mind that we’ve been told that these price increases are due to costs in raw materials + inflation + the currency environment. The question isn’t should raw revenue be increasing (inflation alone causes this to happen for even stagnant companies), but rather: is that 3% really for all of the mentioned factors or is it just padding the bottom line? Given the severity of the last several price increases, i think your average gamer could be forgiven for being a bit miffed at the jump in prices. That said, from what I can see, they needed it to happen.

And there we get to the root of GW’s problem. Their competitor companies (by which I mean companies making plastic 28mm toy soldiers), such as Warlord, Mantic, Perry Miniatures and Victrix, *didn’t* need it to happen. They are able to sell boxes of plastic models at a fraction of GW’s price, even after online discount. This tells me GW are inefficient at what they can do.

Given that for the first time in nearly 30 years, there are now companies that are competing with GW on their home turf of plastic toy soldiers, that many of them are run by former GW employees, and they can outcompete GW on price, even though they do not have the economies of scale that GW does. It makes one wonder doesn’t it.

My interpretation is that GW perhaps have been taking their customer base for granted, and that they are taking big risks in increasing prices (and not just the headlined price rises, but also the “sneak” price rises – reducing the model count per box, reducing the contents of Batallion boxes, etc.). Sure, reducing prices isn’t an option for them as it would cost too much in the short term, but they seem unmindful of the risks of increasing them.

Also, I am highly skeptical of GW using cost+ excuses for price rises. Make no mistake: GW’s price rise are driven by their interpretation of demand. They believe they can sell plastic models at the same price they sell their metal ones. They say so in the annual report. There’s no cost influence in that decision. Sure, costs have gone up a bit, but nowhere near the level of their prices. In any case, raw materials are such a paltry element of their costs in comparison to their sales and distribution network (that apparently they cannot run as competitively as their competitors can) that any increases in cost their should just add pennies to the models.

First thanks for the post, I used to break out the annual report and look it over as I’m an ultra minor stockholder (5 shares thank you very much) and my home gaming group has always been really GW-centric so there are lots of late night discussions regarding GWs moves. But I haven’t done that for a few years to be honest … I’ve moved a bit away from being a GW only gamer to doing alot of other stuff so my deep interest in GW has waned a bit … yet I still consider myself a rabid fanboy and I love GW despite getting ticked off at the this or that aspect of the hobby or their price hikes or what have you.

I completely agree with Osbad on the point that the big sea change occurring for GW is increasing competition in the marketplace. See GW basically is subsidizing employees in both the UK and the US on the manufacturing side of things. I personally applaud that and sincerely wish more companies would do that. But these little competitors (Wargame Factory Plastics) are beginning to produce minis with automation and/or in eastern Europe or China at much, much lower prices. Also they don’t have the crushing overhead that GW has with a global network of employees and big marketing campaigns to support the product. They just produce things that gamers can buy to compliment (or fully supplant) GW minis. Mantic, Wargame Factory Plastics, etc. etc. don’t have to worry about any of those costs … the GW customer base seeks them out … in part for further variety customization … and in part because their products are cheaper. So I believe that in short … over the coming years GW will either have to change its business model or run the risk of taking ever increasing hits to its bottom line due to heavily increased competition. I don’t think that is a bad thing … its good for we the consumer … but sadly it might be bad for GW employees as making stuff in China for a company like GW seems like an inevitability.

Also for the record I’d love to see BOTH Necromunda and Mordheim re-issued maybe akin to Space Hulk (minus the stupid limited run BS) … even if they leave the rules alone … just round out the ranges and perhaps do em up in cheaper plastic sets or something.

I think GWs main hidden (not to us gamers … but perhaps to the world) asset is its IP. GW really needs to focus on strategically using its IP to much greater effect. Farming it out to FFG and THQ is not the best course of action. GW needs to get out there and get some quality partners (more along the lines of what it had for WAR with EA/Mythic) to broaden and deepen the potential for their IP. Little plastic toys … I love … I love … personally … but those aren’t going to drive large sales numbers. The mini game segment of the gaming industry is small. GW is a big fish in that small pond, but if they became a company that really capitalized on its brilliant IP … they could really start seeing some big numbers. If I was Mr. Kirby I’d be hat in hand to Mr. Peter Jackson, to EA to Bioware, etc. etc. enlightening those folks about one of the best kept geek secrets his company is. We GW fans know how awesome, interesting and different the 40K and WHFB universes really are and how they are still so ripe they are for some really solid films and video games.

Ya the Ultramarines movie sounds cool … but other than the amazing Mr. Abnett writing for it … it sounds pretty B grade to me … before anyone jumps on me for heresy … believe me when I say I hope I’m miserably wrong about it. I just don’t see it being anywhere close to what it possibly could be … as with most of the use of GWs amazing IP. Most video games (with the exception of the pre-THQ bought out Relic title “Dawn of War”) have been crappy low grade licensed product and the only film has been goofy fan done stuff. WAR was a step in the right direction … but that was not GW’s doing that was just the marketplace at work and EA gambling on something that might have given WoW a run for its money.

Thanks for the update. Its only now I learned that GW is a publicly traded company, and feel very happy I can research on them.

Q: Having defined a narrow strategy, will GW diversify? The Gamer Market may be niche, and given their efficiency they can probably capture a certain amount of the annual budget of their gamers. As a successful catering strategy has been developed for this, one way I see them growing is diversifying in some way to slowly cost efficiently draw from the other markets.

If they move their production towards a children’s line, by making them child safer, they can have an introductory line for the next generation.

@ comparative costs to other minitures. Without numbers to compare, GW price in minis is their dominant strategy. To assume they can go lower (although as a cheap-ass gamer I wish) one needs to see how sustainable the numbers are in those other companies. Given the life span or the Visibility of these companies, I think marketing is a BIG risk and factors in the price difference. The saying that a barbie is 90% marketing cost, doesn’t make the barbie’s value lower, because parents are still buying it. Same goes to GW, their marketing may be a large part of the cost, but just removing it may free fall them to some big losses.

The information needed to lower costs, because market size will make up the difference in scale is pretty much available for a company like GW. If they did not act on it to bring down their price, then it may not be that big.

Also added value is another aspect of the price difference. To people who can the price difference doesn’t make a lifestyle hit, no problem. But for those like me who can’t afford the difference (I buy miniart) then tough beans.